Automate sales reconciliation and transform forecasting accuracy: Here's how Adobe did it

From chaos to clarity: Why SEs and AEs can’t ignore sales reconciliation

For sales teams working in Salesforce—especially SEs and AEs—closing a deal is only part of the picture. What happens after the quote is accepted? What happens when financial systems don’t match what’s in Salesforce?

That’s where sales reconciliation comes in.

What really happens when systems don’t align

Sales reconciliation is the process of ensuring that revenue transactions in Salesforce match financial records. It sounds simple—but in practice, it’s anything but.

For enterprise sales organizations, reconciliation often means piecing together fragmented sales data from multiple Salesforce orgs, manually comparing it to finance systems, and chasing down discrepancies. The result?

❌ Hours lost to manual processes

❌ Inaccurate revenue reporting

❌ Delayed forecasting cycles

❌ Compliance risks and audit headaches

Without automation, reconciliation becomes a bottleneck that drags down your sales velocity and exposes your business to risk.

You hit your number, but finance reports a different story. Your forecast is off. Leadership starts asking questions. And now you're chasing down a discrepancy instead of closing your next deal.

Why SEs and AEs should care

As a Salesforce SE or AE, your job is to deliver strategic value. But inaccurate data—especially around bookings and revenue—can stall that mission.

When reconciliation is delayed, sales teams lose visibility into pipeline accuracy. You might think a deal has closed and revenue is recognized, but finance tells a different story. And when those discrepancies aren’t caught early, forecasting becomes guesswork.

According to Deloitte, companies with manual reconciliation processes experience 25% higher operational costs, 70% longer audit cycles, and 3x the risk of financial misstatements.

Adobe’s pivot: Scaling without the spreadsheet pain

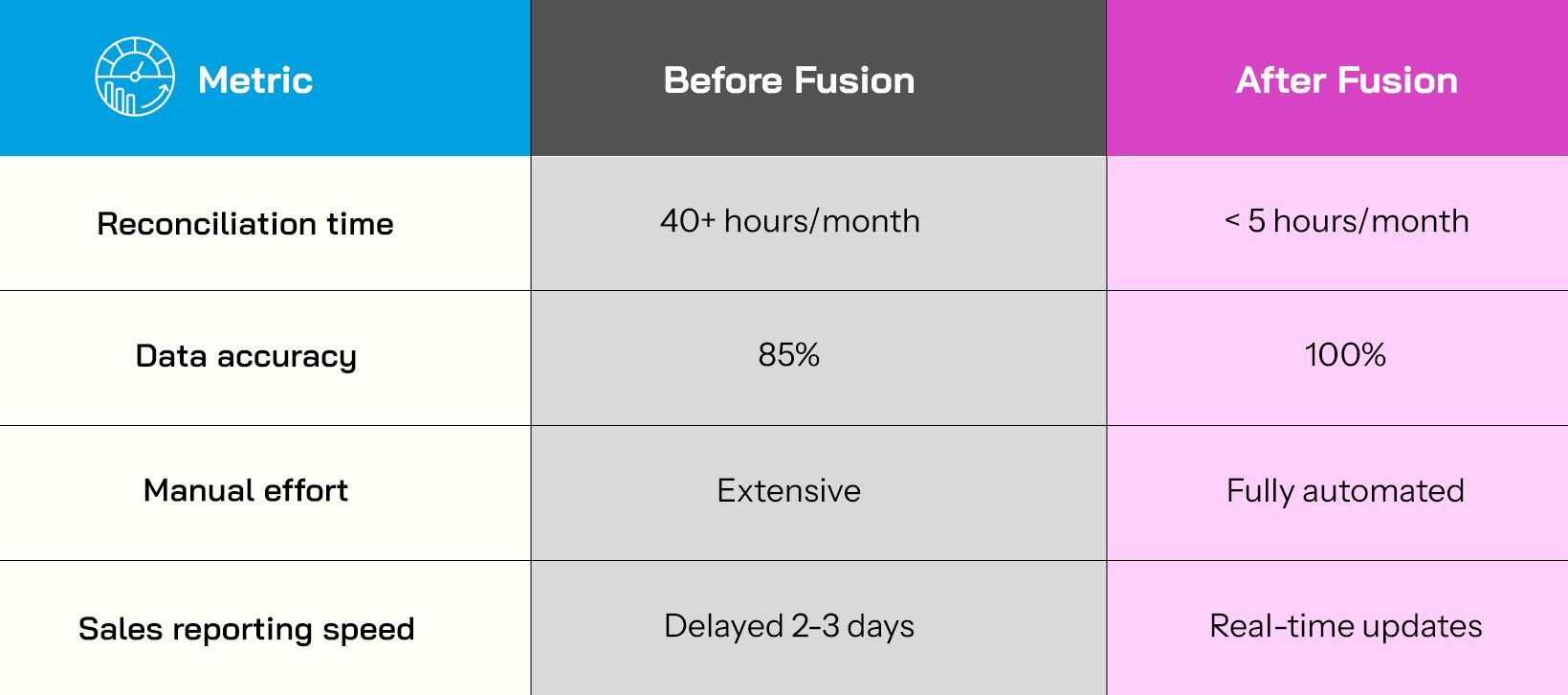

Adobe faced exactly this challenge. With multiple Salesforce orgs and manual reconciliation processes, the finance team was spending several hours per month reconciling sales transactions. Errors were frequent, and the data was often outdated by the time reports were shared.

Here’s what changed when Adobe implemented Valorx Fusion:

Fusion gave Adobe a single, automated system for reconciliation—built directly into Salesforce and Excel—so teams could match transactions in minutes, not days.

The reconciliation workflow—without the friction

With Valorx Fusion, SEs and AEs don’t need to become finance experts. Instead, they get real-time insight into how deals flow through the system—and confidence that their numbers are accurate.

Here’s how it works:

1. Pull data in real time

Connect multiple Salesforce orgs and pull in opportunity, invoice, and custom reconciliation data.

2. Apply reconciliation logic

Identify mismatches, missing entries, and duplicates automatically using built-in logic.

3. Highlight discrepancies

Color-coded reports make it easy to see and address issues.

4. Update Salesforce in bulk

Fix records directly in Excel and sync them back to Salesforce instantly.

Who benefits—and how

✅ Sales Ops - Real-time visibility into bookings accuracy and clean forecasting data.

✅ Finance - Faster closes, reduced audit risks, and accurate revenue records.

✅ Salesforce Admins & IT - Fewer support tickets and streamlined data integrity across orgs.

A better foundation for forecasting

Accurate reconciliation doesn’t just help finance—it directly impacts sales planning and forecasting. According to our Forecasting Guide:

- Businesses with strong data integrity improve forecast accuracy.

- They reduce revenue leakage and accelerate decision-making.

- And they achieve faster sales cycles thanks to real-time financial alignment.

In short, reconciliation is not just a finance problem. It’s a sales growth problem.

Reconciliation made easy: The Valorx approach

See what’s possible with Fusion

Salesforce teams at Adobe and other enterprises are already seeing the difference. Whether you're reconciling across two orgs or twenty, Valorx Fusion makes it possible to do so at scale—without changing the tools your teams already use.

FAQs

1. What is sales reconciliation, and why is it important?

Sales reconciliation ensures that sales transactions recorded in Salesforce match financial records, preventing revenue misreporting and improving financial accuracy.

2. How does Valorx Fusion simplify sales reconciliation?

Valorx Fusion automates data extraction, matching, and reporting, reducing manual effort and ensuring real-time accuracy across multiple Salesforce orgs.

3. How does data integrity impact revenue forecasting?

Accurate data improves forecast reliability, enabling better sales planning, pricing strategies, and financial decision-making.

4. How quickly can companies implement Valorx Fusion?

Most companies can implement Valorx Fusion within days or weeks, depending on their Salesforce setup and reconciliation needs.

5. Is my financial data secure with Valorx Fusion?

Yes, Valorx Fusion follows Salesforce security protocols, ensuring your data remains protected and compliant.

6. Can finance teams use Valorx Fusion without IT support?

Yes, Fusion’s Excel-based interface makes it user-friendly for finance teams without requiring technical expertise.

CRM-Connected spreadsheets

Get a demo for Fusion

Power complex quoting and forecasting with CRM-connected spreadsheets.